So you got a job offer in NYC - congrats! But before you start apartment hunting, let's talk about the elephant in the room: taxes.

I learned this the hard way when I moved here. That $55,000 salary? After Uncle Sam, New York State, and the city all take their cut, you're looking at about $43,000 - or roughly $3,600 a month. Based on Talent.com's New York tax calculator, you'll be taxed $11,959, leaving you with a net pay of $43,041 per year with an average tax rate of 21.7% and marginal tax rate of 36.0%. Ouch.

Here's the breakdown nobody talks about during salary negotiations, plus some tricks I've picked up to keep more money in your pocket.

Table of Contents

- The Triple Whammy: Federal, State, and NYC Local Taxes

- Where Your Money Actually Goes (Paycheck Deductions)

- Tools That Actually Work for NYC Salary Calculations

- Keep More Money Without Getting a Raise

- Decoding Your Pay Stub

- Weird NYC Tax Stuff You Might Hit

- How Smart Housing Choices Maximize Your Budget

TL;DR

- NYC residents get hit with three layers of income tax: federal (10-37%), New York State (4-10.9%), and NYC local tax (3.1-3.9%)

- FICA taxes take another 7.65% of your income, plus New York's disability insurance adds 0.5%

- Online calculators give you realistic take-home estimates - use at least two to double-check

- Pre-tax benefits (401k, HSA, transit passes) can significantly boost your actual spending power

- Your residency status determines NYC local taxes - even temporary residents often qualify

- Bi-weekly pay means 26 paychecks vs 24 semi-monthly (affects cash flow, not total taxes)

The Triple Whammy: Federal, State, and NYC Local Taxes

Working in NYC means three different governments want a piece of your paycheck. Most people know about federal and state taxes, but that NYC local tax? That's the surprise that'll get you.

Understanding this structure is crucial because it's the foundation for calculating your real take-home pay. When you're using any online calculator, make sure it accounts for all three layers - generic tools will lowball your taxes every time.

Federal Income Tax: Your Biggest Hit

Federal taxes typically eat the largest chunk of your paycheck, using a progressive system where your rate increases as you earn more. The rates range from 10% to 37% for 2024, but here's the key thing people get wrong - you don't pay the top rate on all your income.

Only the portion that falls into each bracket gets taxed at that rate. So earning more money never results in taking home less - that's a myth that keeps people from pursuing raises.

How Progressive Tax Brackets Actually Work

Say you earn $60,000 annually. You don't pay 22% on the entire amount. Instead:

- 10% on the first $11,000 ($1,100)

- 12% on income from $11,001 to $44,725 ($4,047)

- 22% on the remaining $15,275 ($3,361)

Total federal tax: $8,508 before deductions. See how that works?

Standard Deduction vs. Itemizing

For 2024, single filers get a $13,850 standard deduction automatically. You'll only want to itemize if your mortgage interest, charitable donations, and other expenses exceed this amount - pretty rare for most NYC renters.

Most of us end up taking the standard deduction because itemizing requires significant expenses that renters typically don't have.

New York State: Another Layer

New York State income tax ranges from 4% to 10.9% depending on your income level. According to SmartAsset's New York paycheck calculator, New York state has a progressive income tax system with rates ranging from 4% to 10.9% depending on a taxpayer's income level and filing status, with the median household income at $82,095.

Eight Tax Brackets Mean Gradual Increases

New York uses eight different tax brackets, so your rate increases gradually as your income rises:

|

Income Range (Single Filer) |

Tax Rate |

|---|---|

|

$0 - $8,500 |

4.00% |

|

$8,501 - $11,700 |

4.50% |

|

$11,701 - $13,900 |

5.25% |

|

$13,901 - $80,650 |

5.85% |

|

$80,651 - $215,400 |

6.25% |

|

$215,401 - $1,077,550 |

6.85% |

|

$1,077,551 - $5,000,000 |

9.65% |

|

$5,000,001+ |

10.90% |

This gradual system means you won't see dramatic jumps in your tax burden when you get promoted.

State Deductions That Could Save You Money

New York offers various deductions beyond the standard amount, including some that don't exist at the federal level. Students can particularly benefit from education-related deductions like the SUNY/CUNY tuition deduction.

These state-specific deductions can add up to meaningful savings, especially if you're paying for education expenses.

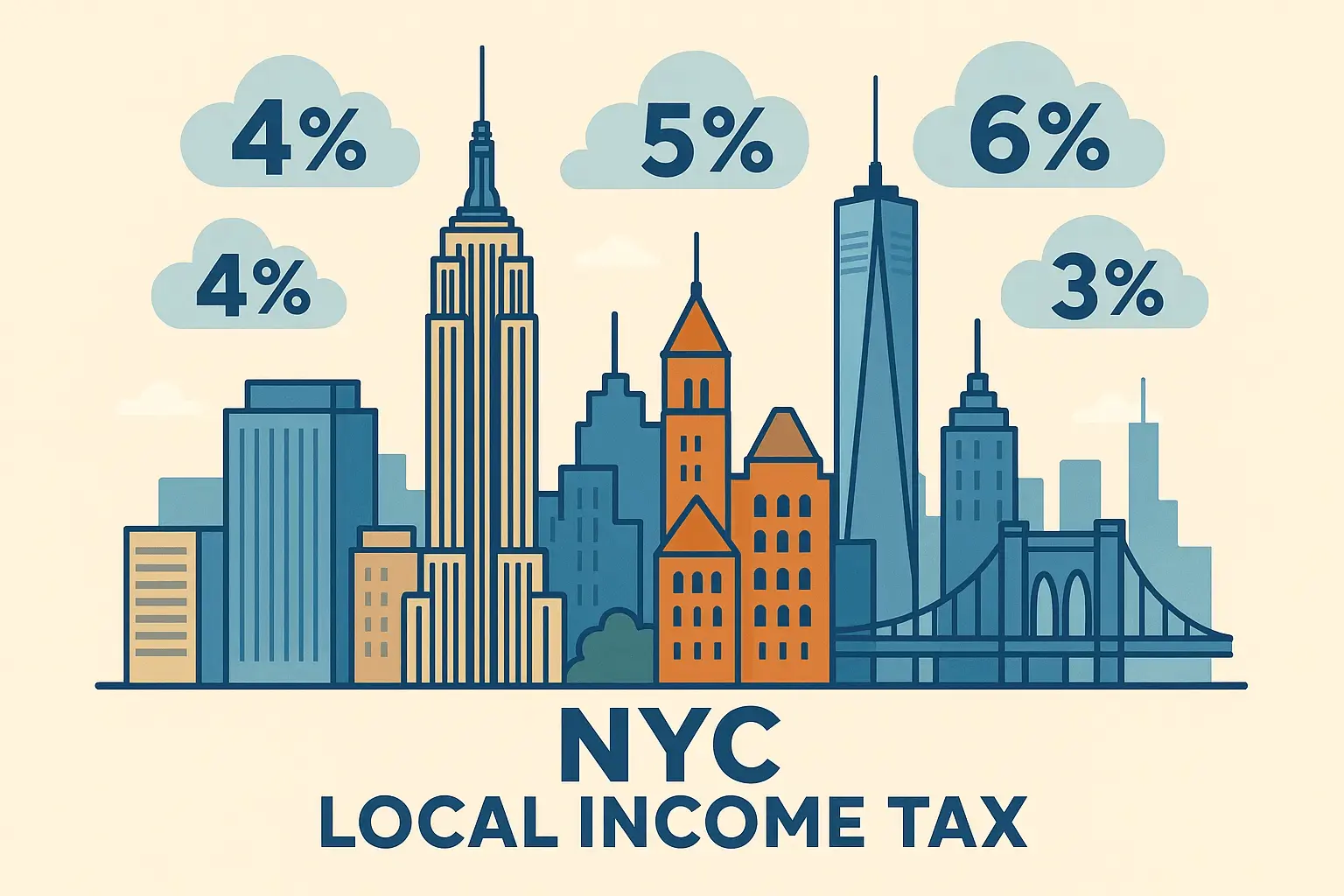

NYC Local Tax: The Final Punch

Here's what catches people off guard - New York City charges its own income tax on top of federal and state taxes. We're one of the few cities in America that does this.

Based on SmartAsset's analysis, NYC's local tax rates are progressive and range from 3.078% to 3.876%, with four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers.

Resident vs. Non-Resident: It's Complicated

Your NYC tax obligation isn't about where you work - it's about where you live and how much time you spend in the city. Students and interns often qualify as residents even if they think their stay is temporary.

The residency rules catch people off guard all the time. I've seen plenty of interns and students who thought they were exempt, only to discover they qualified as residents and owed money they hadn't budgeted for.

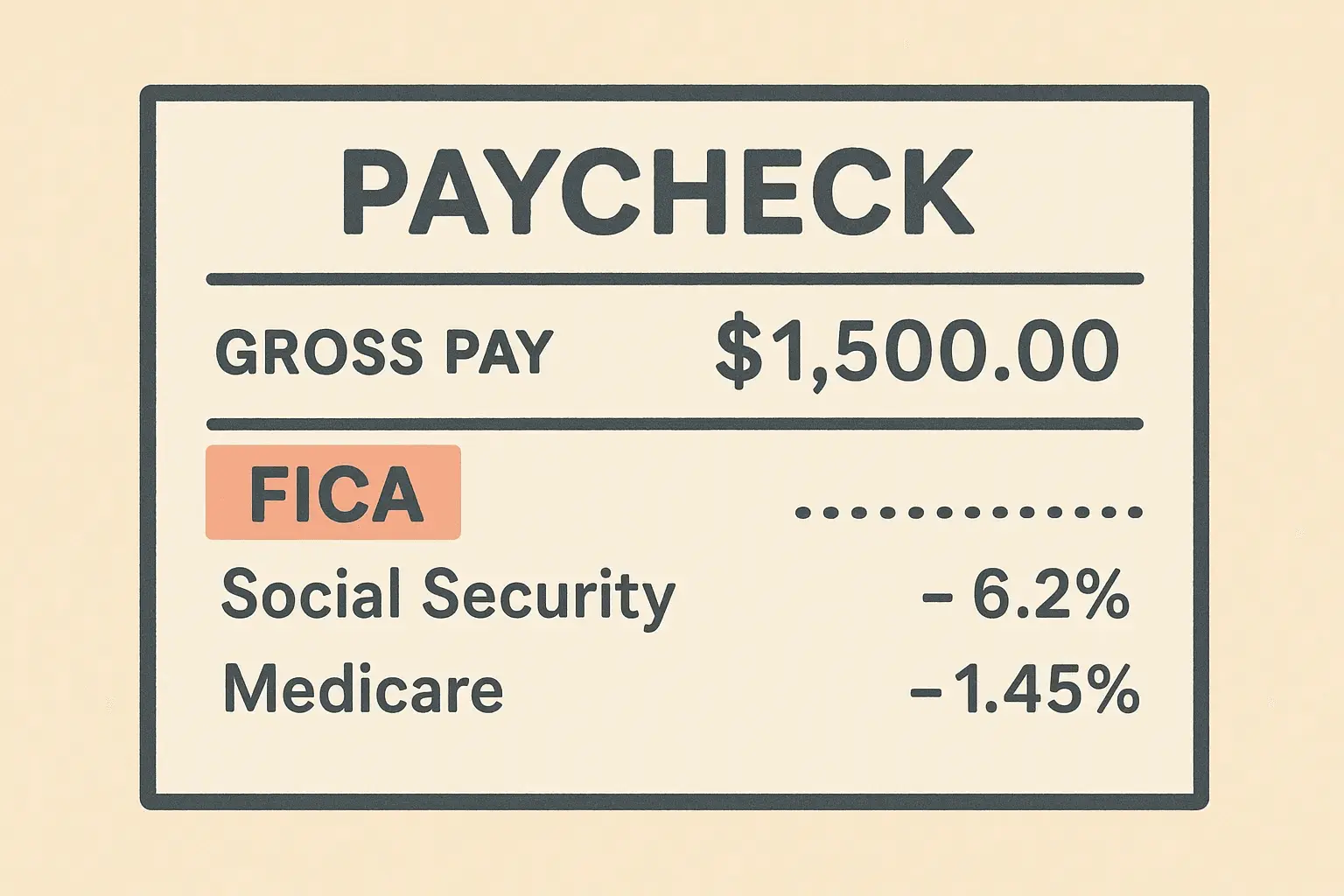

Where Your Money Actually Goes (Paycheck Deductions)

Beyond income taxes, several other deductions come out of every paycheck automatically. These include Social Security, Medicare, and New York's disability insurance - stuff that adds up fast.

When you look at any NYC paycheck, you'll see these deductions listed separately from income taxes. Understanding what they are helps you verify that online calculators are giving you accurate numbers.

FICA Taxes: Social Security and Medicare

FICA taxes fund Social Security and Medicare. Every employee pays the same rates regardless of income level (with some caps), and your employer matches what you pay.

Social Security Tax Has an Income Cap

You pay 6.2% on income up to $160,200 in 2024, then nothing above that amount. Most NYC workers pay Social Security tax on their entire salary, but high earners get a break once they hit the cap.

Medicare Tax Applies to Everything

The 1.45% Medicare tax has no income limit, and high earners ($200,000+) pay an additional 0.9% on top. Unlike Social Security, Medicare tax never stops - every dollar you earn gets hit with at least the base rate.

New York State Disability Insurance

New York requires all employees to contribute 0.5% of their wages to the state's disability insurance program. It's relatively small compared to other taxes, but it adds up over time and provides protection if you can't work due to illness or injury.

Recent analysis shows that high-earning professionals face significant tax burdens across states. According to a September 2024 GOBankingRates study examining "$100K salary looks like after taxes in your state," New York residents earning six figures face some of the highest effective tax rates in the nation, making understanding all paycheck deductions even more critical for financial planning.

Tools That Actually Work for NYC Salary Calculations

Online calculators have gotten incredibly sophisticated and can give you accurate estimates before you accept a job offer. I've tested dozens of these tools - some are definitely better than others for handling NYC's complex tax situation.

The right tool can save you from unpleasant surprises when you get your first paycheck. Here are the ones that actually get NYC right.

Top Online Calculators for NYC

Several calculators specialize in NYC's complex tax situation, accounting for all three levels of income tax plus payroll deductions. The best ones update their tax rates automatically and include all the local considerations that generic tools miss.

ADP Calculator: My Go-To for "What If" Scenarios

ADP's calculator handles all federal, state, and local taxes while letting you adjust for different benefit elections. Want to see how maxing out your 401k affects your take-home pay? This shows you instantly.

The customization options make this my top recommendation for people who want to model different scenarios during salary negotiations.

SmartAsset: Best for Quick Calculations

SmartAsset's NYC-specific calculator includes all the local tax considerations and updates automatically when tax rates change. Clean interface, accurate numbers - perfect for salary negotiations.

What I appreciate about SmartAsset is that it doesn't try to do too much. The focus on accuracy and simplicity makes it reliable for quick calculations.

PaycheckCity: For Numbers Nerds

PaycheckCity shows you exactly how each tax and deduction impacts your final amount. The detailed breakdown is educational and useful if you want to understand where every dollar goes.

Mobile Apps for On-the-Go Calculations

Smartphone apps make it easy to calculate take-home pay during salary negotiations. The best apps sync with current tax rates and let you quickly adjust variables.

Pre-Job Offer Checklist:

- Calculate take-home pay using at least two different calculators

- Factor in all three tax levels (federal, state, NYC local)

- Include FICA and New York disability insurance

- Account for any pre-tax benefit deductions

- Consider your residency status for NYC tax purposes

- Compare monthly vs. bi-weekly pay schedules

Keep More Money Without Getting a Raise

Pre-tax benefits are your secret weapon for increasing take-home pay. By reducing your taxable income through strategic benefit elections, you can keep significantly more of what you earn while building long-term financial security.

The math works in your favor because you're avoiding taxes at your marginal rate. If you're in the 22% federal bracket plus state and local taxes, every pre-tax dollar you contribute could save you 35 cents or more in taxes.

Pre-Tax Benefits: Your Best Friend

Every dollar you contribute to pre-tax benefits reduces your taxable income, which means you save money on federal, state, and local taxes. The savings add up quickly in NYC's high-tax environment.

401(k) Contributions: Immediate and Long-Term Benefits

Contributing to your employer's 401(k) plan reduces your current taxable income while building retirement savings. If your employer offers matching contributions, you're literally getting free money on top of the tax savings.

Real example: My friend Sarah makes $65k and contributes $5k to her 401k. This reduces her taxable income to $60,000, saving her approximately $1,800 in combined federal, state, and local taxes. Plus her company matches $2,500. That's $4,300 in her pocket for doing basically nothing.

Health Savings Accounts: Triple Tax Advantage

HSAs offer three tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. They're only available with high-deductible health plans, but the tax savings can be substantial.

The triple tax advantage makes HSAs one of the most powerful tax-advantaged accounts available - most people don't even know about this.

Transit Benefits: Perfect for NYC

Most NYC employers offer pre-tax transit benefits that let you pay for subway, bus, and parking expenses with pre-tax dollars. That monthly MetroCard costs $132 - pay for it pre-tax and save about $47 annually.

You're essentially getting a discount on transportation you're already paying for.

Year-End Tax Planning Strategies

Strategic planning near year-end can help optimize your tax situation. Timing income and deductions carefully can help you manage your tax bracket and overall liability.

|

Pre-Tax Benefit |

Annual Limit (2024) |

Estimated Tax Savings* |

|---|---|---|

|

401(k) Contribution |

$23,000 |

$8,280 |

|

HSA (Individual) |

$4,300 |

$1,548 |

|

FSA (Healthcare) |

$3,200 |

$1,152 |

|

Transit Benefits |

$3,120 |

$1,123 |

|

Dependent Care FSA |

$5,000 |

$1,800 |

*Based on 36% marginal tax rate (federal, state, and local combined)

Decoding Your Pay Stub

Your first NYC paycheck will look like alphabet soup. Understanding what all those abbreviations and numbers mean helps you verify accuracy and spot any errors.

Your pay stub contains a wealth of information that most people ignore. Learning to read it properly helps you catch errors and understand exactly how your employer calculates your take-home pay.

Gross Pay Components

Your gross pay includes more than your base salary - it covers overtime, bonuses, commissions, and other compensation before any deductions. Overtime calculations can get complex, so make sure you understand your employer's policy.

Pre-Tax vs. Post-Tax Deductions

Pre-tax deductions reduce your taxable income and appear before tax calculations on your pay stub. Post-tax deductions come out after taxes are calculated and don't provide immediate tax benefits.

The order matters because pre-tax deductions reduce the amount subject to income taxes, while post-tax deductions come out of your already-taxed income.

How Pay Frequency Affects Cash Flow

Whether you're paid weekly, bi-weekly, semi-monthly, or monthly affects your cash flow more than your total annual taxes. Bi-weekly pay results in 26 paychecks per year versus 24 for semi-monthly.

Marcus earns $60,000 annually. With bi-weekly pay, he receives $2,308 every two weeks for 26 paychecks. With semi-monthly pay, he gets $2,500 twice per month for 24 paychecks. The bi-weekly schedule gives him two "extra" paychecks per year.

When budgeting with irregular pay schedules, having predictable housing costs becomes essential, which is why many young professionals choose furnished options such as The Lenox House that include utilities and amenities in one monthly payment.

Pay Stub Review Checklist:

- Verify gross pay matches your expected salary/hourly rate

- Check that federal tax withholding aligns with your W-4

- Confirm state and local tax deductions are accurate

- Review pre-tax deduction amounts (401k, insurance, etc.)

- Ensure FICA taxes are calculated correctly (7.65% total)

- Verify New York disability insurance deduction (0.5%)

Weird NYC Tax Stuff You Might Hit

Some NYC workers face additional tax complications beyond standard income taxes. These situations often catch people off guard because standard online tools don't account for them.

Unincorporated Business Tax for Freelancers

NYC's Unincorporated Business Tax applies to freelancers and independent contractors with net income over $100,000. This additional tax layer can significantly impact high-earning freelancers who aren't prepared for it.

The $100,000 threshold is based on net income after business expenses. Freelancers who gross significantly more than $100,000 but have substantial business expenses might still avoid this tax.

Residency Rules and Their Tax Implications

Your residency status for tax purposes depends on where you maintain your permanent home and spend most of your time. Students and temporary workers need to understand how their NYC residence affects their tax obligations.

High-profile athletes demonstrate the complexity of multi-state tax obligations. Recent reporting on Juan Soto's record-breaking Mets contract reveals that he'll pay approximately $364 million in federal, state, and municipal taxes over his 15-year deal, including $33.8 million to New York State alone, highlighting how residency and income location significantly impact tax liability.

Temporary vs. Permanent Residence Considerations

Even temporary NYC residents often qualify for local tax obligations, which can be surprising for students and interns who consider their stay short-term. Understanding these rules helps you plan appropriately.

For students and interns navigating residency requirements, temporary housing solutions such as The Heritage House provide flexibility while helping establish clear residency documentation for tax purposes.

How Smart Housing Choices Maximize Your Take-Home Pay

When NYC's complex tax situation can reduce your gross salary by 25-35% or more, having predictable housing costs becomes crucial for financial planning. All-inclusive housing options with flexible payment schedules work with your actual paycheck timing rather than against it.

Strategic locations near major employment hubs help minimize transportation costs, while understanding your true after-tax income helps you make informed housing decisions that won't strain your finances. Whether you're looking at premium locations such as The Park Avenue House or more budget-friendly options, knowing your real take-home pay prevents financial surprises.

Ready to see how much you can actually afford? Contact Student Housing NYC today to discuss housing options that fit your real take-home pay.

The Bottom Line

NYC taxes are complicated, expensive, and unavoidable. But knowing what you're dealing with beats getting blindsided by your first paycheck.

Your tax situation is unique, and factors such as residency status, benefit elections, and income sources all play a role in determining your final paycheck amount. Use the calculators and strategies I've shared to get accurate estimates, but don't hesitate to consult with a tax professional if your situation gets complex.

The sticker shock wears off eventually. The city's expensive, but the opportunities and experiences make it worth it. Just budget with your real take-home pay, not your gross salary.

Your financial future in NYC depends on understanding exactly what you'll actually take home - not what you'll earn on paper. Smart financial planning starts with understanding your true income, and extends to making cost-effective housing choices - explore how Student Housing NYC works to see how their transparent pricing model helps you budget effectively with your actual take-home pay.